The future of car dealerships & automotive retail - The shifting face to the customer

In the year 2000, almost 20 years ago now, someone planning to buy a car spent days or even weeks going from one dealership to another speaking to sales rep after sales rep just to ensure they got the best deal for their future vehicle. Google just celebrated its second birthday and internet research barely existed back then - not to mention buying a car online. Sure, autobytel tried it and advertised itself as the first “automotive e-tailer”, but the DotCom bubble busted the ecommerce-dream. Now, two decades into our story, a fundamental shift has taken place in the way we perceive mobility as well as how our needs for it are being served.

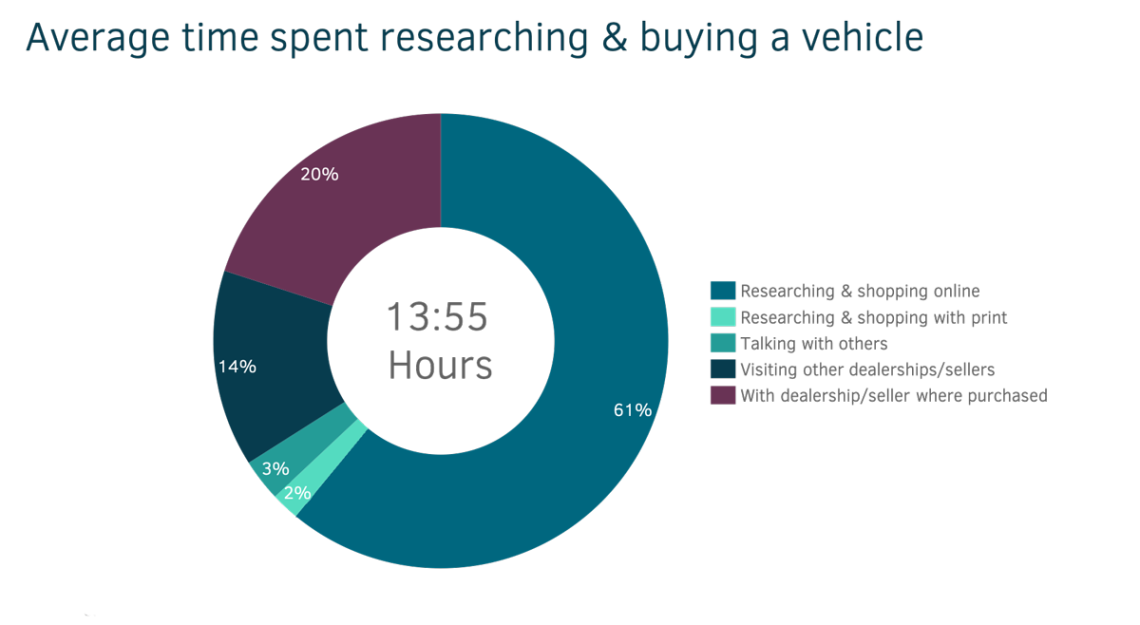

The same buyer from 2000 - let´s call her Meghan - nowadays has more than 900 digital interactions, so-called touchpoints, ranging from advertisement to well researched reviews, before she even sets foot into a dealership.

And when Meghan does, she has done extensive research, she knows the price of car models and has become a self-made car expert with as much knowledge about these models as some sales reps. As a result, nowadays dealerships are visited an average of one or two times. In contrast, in the old days where dealerships were the only source of information, customers visited an average of 7 times before purchasing a car.

Source: Cox Automotive, 2019

So why is there a need for car dealerships if Meghan has already made her decision before setting foot in one? “There is no need!” – some might answer. Some, in this case, mainly refers to car manufacturers like Tesla, which have moved away from traditional dealerships entirely. “There definitely is a need,” more established car manufacturers with an existing and well established dealership network answer, “but the manufacturer-dealer relationship needs to change”.

In order to stay relevant, this relationship, and with it the business model of dealerships, truly does need to change – reasons being shifting customer expectations, the growing trend of using a car instead of owning it, and the rapid uptake of EVs.

The last-mentioned especially threatens the service- and parts departments’ revenue streams in each dealership, as their required maintenance is much lower than that of internal combustion engine vehicles (ICEV). This threat might not seem imminent, but with growing numbers of sold EVs and service operations being the biggest contributor to profit at a dealership, there is a clear need for change.

Mobility as a service - Selling mobility is on the rise

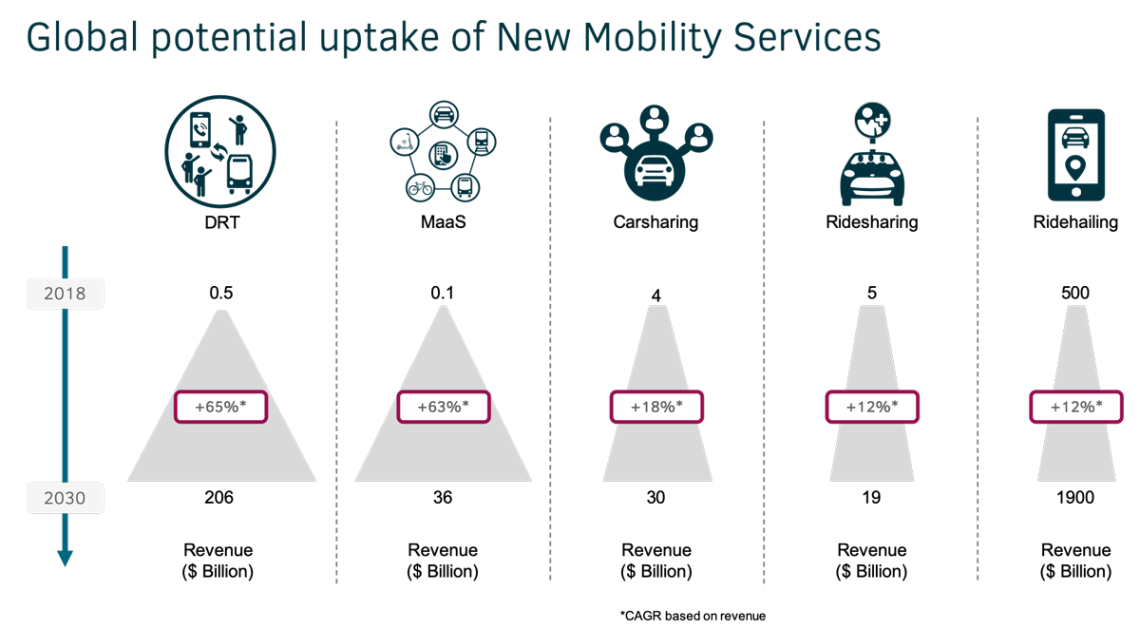

In addition to the threat of losing their biggest revenue stream, dealerships are confronted with a decline of car sales as well. This decline is fueled by several market-trends such as carsharing, ridehailing, Demand Responsive Transit (DRT), ride sharing and additional forms of Mobility as a Service (MaaS).

Globally these markets are rapidly increasing in size and significance, having an expected combined revenue of 2.191 billion USD in 2030 – in comparison to 509.4 billion USD in 2018– a number higher than the current yearly revenue for new car sales worldwide.

Source: Graphical illustration by accilium, Data-source by Frost and Sullivan 2019

Rapid shifts, crumbling revenue streams and Meghan’s shifting expectations: In isolation perhaps none of the aforementioned would lead to a need to alter the landscape for car dealerships. But fending off all three at once? To answer the question of how dealers can master their evolution into this new mobility ecosystem, we look at two different showcases, designed for dealerships in need for reinventing their business.

By switching our perspective and slipping into the role of a dealership, we want to elaborate on ideas they might need to pursue in order to master the necessary transformation. Those ideas range from conservative to radical and while each of them is worth looking into, we will take a closer look at two of them – one from each side of the sliding scale.

Source: accilium, 2019

Showcase 1 – A rather conservative approach: Used cars have a much higher value than their selling price.

When speaking of used cars, we constantly see the dilemma of them being an important revenue stream for dealerships, while at the same time being a liability due to the costs of real estate, flooring, depreciation and marketing. Sure, the same applies for new cars, but each kilometer above 0 on the mileage counter is much more crucial to the selling-price than for used cars.

In times where ridehailing meant disenfranchised taxi drivers being on the streets 10+ hours a day, there was no connection to used cars at the dealership waiting to be sold. Then Uber came, followed by Lyft and countless others, transforming ridehailing into the convenient experience we have today. Combining the current ridehailing situation with used cars standing around is a perfect match. Showroom used car by day, Uber-drivers car by night. Generating additional revenue for the dealer with each driven kilometer.

The infrastructure is already there, resources and service departments are in place and not a single Euro of additional capital investment is needed to start earning money. Even concerns about cleanliness of the car when returned are redundant, as drivers are rewarded for high ratings from customers and therefore strive to gain a stellar rating – and a clean car is the minimum requirement for that.

So, an asset the dealer has already invested in gains incremental revenue and might later even be bought by the many new customers can not only help withstand the waves of changes dealerships are facing, but also gaining additional revenue by being part of the change.

With the uptake of EVs, the dealership can even offer a complementary service: As for EVs, the mileage on the counter is less important than the state of health (SoH) of the car’s battery. Dealerships can secure their importance in the market by offering services such as SoH checks, which will determine the price for the seller.

Or they determine whether it is worthwhile to replace batteries to increase the selling price for used cars. In order to create transparency and gain the buyers trust in such a service, it is imperative that the SoH services and measurements of the dealer are calibrated and certified. Unfortunately, this isn’t a trivial exercise and requires fundamental knowledge on both vehicle and battery - an asset that accilium and DNV GL bring.

Showcase 2 – category radical: Embracing the digital transformation in car dealerships

The fact that 900 digital touchpoints are made before entering a dealership speaks for itself. Customers want information online, analytical tools which contribute to price transparency and a smooth experience throughout the whole customer journey. While facts about cars can be researched online and tons of recommendations can be found with a few clicks, the experience of sitting in a car and doing a test drive is unique to the physical world and used to require a nearby dealership.

Rapid changes in virtual reality (VR) technology have made it possible to mimic those formerly unique physical experiences in the digital world. Customizing any feature of any available car, inserting technical details to each and every part, or even sitting in the driver´s seat for a virtual ride. While this seems unrealistic, many car manufacturers like Audi or BMW have implemented this technology into their virtual showrooms already. But how can the dealer profit from this technology?

As VR has become a widely available and affordable technology, using it in dealerships for virtual showrooms to customize your car is merely the first step. Despite already having noticeable advantages such as reduced cost of a car dealership due to less needed floor space, shop assistants and car models displayed, the second and much bigger step for dealerships is to improve not only customer experience with VR, but the convenience it can offer them. Just imagine Meghan sitting in her living room, having a cup of tea and visiting a virtual showroom where actual assistants, sitting thousands of kilometers away, are guiding her through the showroom, presenting the latest SUV and offering virtual test drives to her.

But why is it just the dealerships which should reinvent themselves and use technologies like VR to sell cars? The answer is rather easy: If they don´t do it, someone else will step up. As the whole retail industry, far beyond cars, is shifting from point of sale to point of experience, it is just a matter of time till new entrances will be made, offering people a personalized and cooperative experience.

To avoid having a third player stepping up and gaining ground, dealerships can do it by themselves designing many of the 900 online touchpoints, creating points of experience and resulting in a much higher chance of making the sale and securing their future business. If they don´t, national sales companies (NSC) will do it for them on a bigger scale. Even the car manufacturer can offer those services as mentioned above, tuning the dealership into a fulfillment center.

Finding balance between protecting the existing business and entering new segments in car retail will be key.

Both showcases above can contribute to build a successful business model for dealerships and while there are many others which could similarly cater to those challenges, they all need actions which must be taken right away. Actions like focusing on customer centric processes, developing new roles for the dealership such as transformation managers, digital and EV experts as well as giving those new roles the responsibilities needed to drive the transitions forward. For all this it is essential to think beyond current services and business models to develop strategies for such transitions – strategies accilium and DNV GL have already developed and tailored for different industry players.

Maybe soon Meghan thinks back to the year 2000 while taking her VR glasses off, remembering people feeling exhausted visiting dealership after dealership looking for a car, whereas she has just bought her new car in a virtual showroom thousand kilometers away. She leans forward and takes a sip of her tea and smiles, knowing her new car is already on the way.

The article was published by Johannes Scherrer and Alexander Hotowy [accilium] in coorperation with DNV GL Energy