Urban Mobility: Did somebody say cashcow?

Could you think of anything less buzz-generating as writing about taxis? The 100+ year old service of getting you from A to B if sick, drunk, about to give birth or just somewhat in a hurry. It was always there, but it was never really popular (except for the legendary cabs in London and NYC). And out of nowhere it became a market of the two biggest so called “unicorns”, multi-billion companies, backed by unthought-of amounts of VC-cash?

If you are one of those business woman or business man that just needed to catch the early flight, you might have already spent a fortune on these services though. The once dull market of taxis and limousines has become the talk of the town since Uber, Didi, Grab, mytaxi, Gett and plenty of others have arrived to the scene.

The reality of Uber- A unicorn of urban mobility is born

To come close to that phenomenon and perhaps explain why millions of users around the world are already hooked up to an app-based service, we should start right where it began. The myth claims that Travis Kalanick, later founder of Uber, was stuck in Paris in 2009 and was just unable to hail a cab.

So, he envisioned a glorious future of simply pressing a button that will send somebody to pick him up. That obviously became reality. That was and still is a game-changer in the world of ground transportation (Taxis, Private Hire Vehicles and limousines). Taking a ride at your holiday destination became easier, that is a plus. The once segregated and uber-local (pun-intended) market became a world-wide service portfolio.

Pooling (basically public transport comfort in a car or van just a lot more expensive) became the norm in the US. But why is Uber’s worth today higher than that of German car manufactures BMW and Daimler together? Right before the long-awaited 2019 IPO, Uber’s evaluation is at $ 120 Billion. Is it because VC-investors are greedy, hopeful or is there perhaps a business model that might back all those claims?

To put it frankly: No, there is not a working business model (yet). But more to that later.

Uber, Didi, Gett & Co- Framing the global picture of urban mobility provider

It’s mostly about hope – the hope for autonomous cars and sending drivers into unemployment around the globe to save money. The hope for people leaving their own cars behind and ride-hail everywhere. The hope that the customer lifetime value (CLV) will at some point reach the amount of $900+ that e.g. Uber already claims. 1

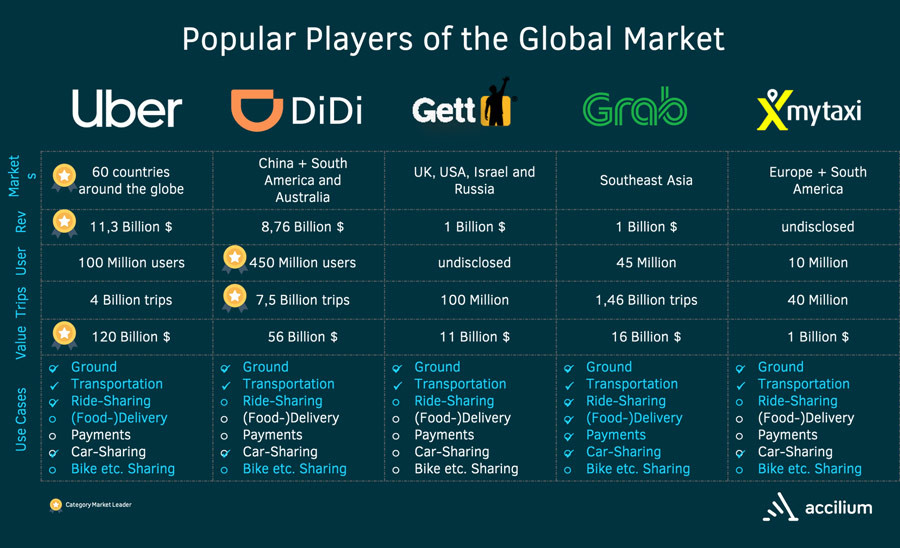

If we take a look at established services around the globe, we can get a quality picture of its market potential:

The graphic shows us that there might be unlimited and still uncapped potential within that market. It shows us too though, that neither of the players were able to generate extraordinarily high revenues. Uber’s revenue was just a mere 6% of e.g. Daimlers in 2018.

To be fully clear, neither of these services were able to earn any positive return. All have burned cash for years now.2

Market potential of urban mobility providers in Germany

Mostly unaffected by all that is the German market. Uber has fewer active cars throughout Germany than the 2nd biggest taxi dispatch center in e.g. Dusseldorf – take that for perspective. mytaxi might be market leader in terms of nation-wide bookings but lost costly wars against drivers/entrepreneurs and the local dispatch centers throughout the years.

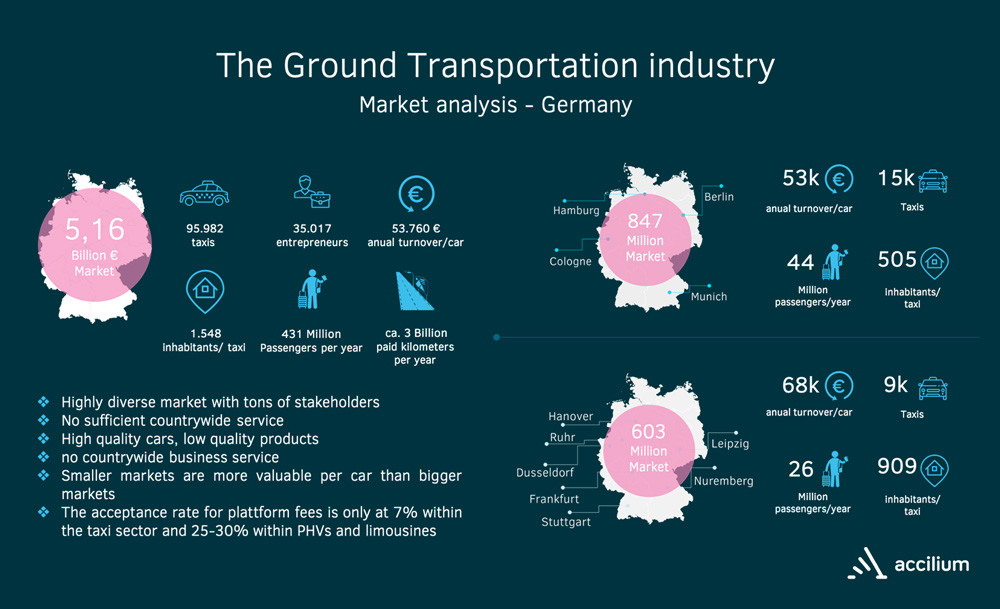

It’s a saturated market of 5bn € revenue with around 100.000 cars already on the street. It’s close to 3 billion kilometers each year that are sold to 430 Million customers. You may be able to grow potentially but not substantially. The margin in ground transport is right around 2%.3

There are two different market types in Germany, small markets and metropolitan markets.

Both have a similar structure since the market is highly regulated. Per car income is actually vastly lower in the metropolitan areas because of higher competition.

The German market might be toughest market to crack in terms of urban mobility in the Western Hemisphere. Tough Regulations, high segregation, low value structure and the sheer endless love-affair with car manufactures in Germany are though hurdles to come by. The biggest one will be forcing people to give up their car and jump into taxi or like-wise ground transportation. Even Berlin saw an enormous increase in car ownership within the last 10 years. 4

If you want to take over any market you better be creative, if you want to take over the German urban mobility market you better be prepared. The concept has to be right – the business model must be too right.

Business Model your way out

Everybody is in love with platforms nowadays. If it’s amazon and eBay in retail, GrubHub and Deliveroo in food delivery or Uber and Didi within ground transport. A platform in ground transport relies heavily on the gig economy (cheap “freelancers”) because employment (of the drivers) would take them out of competition to start with.

Both services are looking towards autonomous vehicles to free them up from high driver costs (up to 60-70% of the GMV). That might be true on one hand, but might put the services out of, …well service, at least according to Assif Shameen from The Edge Singapore

“If the real advantage in ride-hailing is the autonomous car, companies such as Uber, Didi or Grab that have spent years and billions trying to build relationships with drivers may not necessarily have a head start in a business where driverless cabs dominate.” 5

Let that sink in for a moment. Both services have burned more cash than they’ve ever earned, but even the last straw might not be one they’re able to grab. That is especially true if autonomous cars will just start another war of prices. And they certainly will.

So what is a sustainable business model for future ground transportation?

Our main theory for the future is that there is not a bigger market for ground transportation as there is already today. Taxis have defined the maximum prices for decades. Plenty of big companies have ruled out taxi services for their employees to cut costs already. They will not come back to higher prices than before. At very least not in the foreseeable future.

All over the world the largest audience for ground transportation (regular customers) will be found in B2B. If you want to make reliable business “ordinary people” are just not that interesting.

We’re more than happy to discuss that topic further and are engaging you to request more information at any given time. The future of ground transportation might be the hottest topic in town, but there are intriguing ways to come closer to that very issue.

Let’s find out together! For more informations on the urban transport industry, go ahead, download the presentation by filling out form below.

Article published by Tobias Luksch, accilium

Sources:

Image I:

The rise of electric shared and autonomous fleets

Uber: http://www.businessofapps.com/data/uber-statistics/,

Grab: https://vulcanpost.com/641330/grab-annual-revenue-2017/;

Gett: https://www.timesofisrael.com/gett-revenue-totals-1b-seeks-profitability-in-2019-investor-says

Image II:

Text:

[1] https://www.theedgesingapore.com/will-uber-grab-and-didi-ever-make-money

[2] https://venturebeat.com/2017/08/23/uber-is-still-burning-cash-at-a-rate-of-2-billion-a-year/

https://techcrunch.com/2019/02/14/didi-reported-1-6-billion-loss/

https://techcrunch.com/2016/08/04/grab-burn/

https://www.timesofisrael.com/gett-revenue-totals-1b-seeks-profitability-in-2019-investor-says/

[3] https://medium.com/@AsherOfLA/ubers-balance-sheet-says-we-re-not-a-tech-company-e3b6a9561d14

[5] https://www.theedgesingapore.com/will-uber-grab-and-didi-ever-make-money