As we have learned in the first article of this series, policies can have a major impact on the deployment of hydrogen mobility, but still the infrastructure acts as a bottleneck for that deployment. In this article we will show how the breaks on opportunities can be released by looking closely at the entire value chain. Furthermore, this article will discuss FCEV cost barriers and how to overcome them.

Part II: Infrastructure holds the key. Putting the brakes on opportunity

In spite of the promise of beginning to align public and private sector interests and creating early market momentum, the suggested baseline production expansion scenario implies that FCEVs would still only represent around 0.1% of total global vehicle production by the end of the upcoming decade.

With policy support beginning to take hold, technology advantages such as range and refueling time well in favor of FCEVs and OEM competition to help lower costs on the near-term horizon, the majority of remaining issues for H2 mobility to overcome lay firmly planted within the infrastructural segment.

This segment reveals weaknesses at every juncture, ranging from technical and systemic inefficiencies to incompatibility with existing networks, high CAPEX requirements for required build or retrofitting as well as high-risk business models revealing cash gaps on investment returns.

Hurdles at every instance of the value chain:

New infrastructural build will require significant investments considering that existing gas infrastructure will not be able to provide the necessary distribution channels. Existing pipelines could safely only tolerate in the 5% range of hydrogen in a hydrogen-natural gas blend without significant modifications.

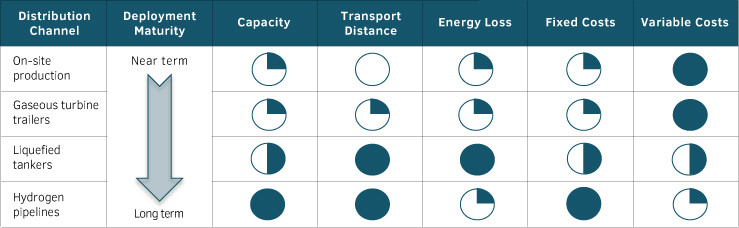

This is too small a share to use existing networks at scale. In addition, the high-pressure requirements in the transport sector mean that repurposing existing pipeline installations is not an option. This further highlights the particular challenge faced by the infrastructural requirements for H2 mobility as it places the near-term focus on solutions that entail high variable costs in combination with low utilization rates, creating the perfect storm of uncertainty.

The outcome, unsurprisingly, is maximum risks on the part of investors. Distribution solutions with a more predictable investment profile are further along the deployment maturity curve.

Crucially, every intersection of the H2 mobility value chain reveals a need for new build, optimization or cost reduction, from primary source energy production to the FCEV fleet itself. This creates a sector with a uniquely high-risk profile comprised of the following components:

1.Raw Materials: Although not costlier for FCEVs as a source than other electric vehicle types, if aiming for true, ‘well to wheel’ zero emissions, more costly renewable sources are required.

2.Production: Lower cost production – as in steam methane reforming (SMR) – faces the issue of yield loss of roughly 15% through required pressure-swing adsorption purification for fuel cell use.

3.Distribution: Possibility for economies of scale at the level of distribution are only just starting to emerge with tube trailers now being developed with refueling capacities of up to 1,000 kg, up from established standards of 300 kg, and 500 bar transport pressures, up from 200 bar.

4.Storage: Hydrogen’s energy density is just 15% that of petrol, which suggests that storage at existing refueling stations is not possible without costly retrofitting or extensive modification of existing infrastructure.

5.Dispensing Technologies: Extended valley of negative cash flow risks the impossibility of the business case. Average public hydrogen refueling station (HRS) investment requirement is still up to $2.5 million in total cost. Under-utilization in early market rollout stages will create a cash gap that could take between 10 and 15 years to recover.

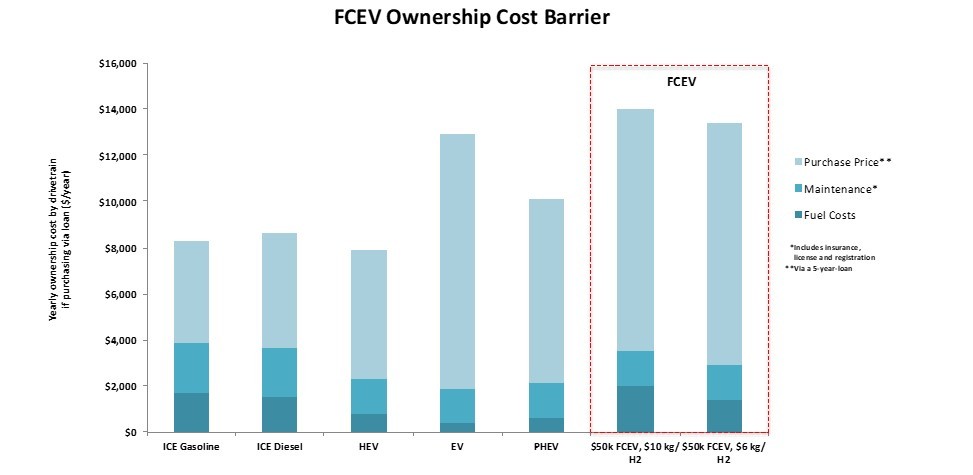

6.Vehicles: Cost of FCEV themselves can range from $50,000 to $100,000 for 80-120 kW capacity vehicles.

7.Cost of Fuel: In addition to vehicle acquisition costs, vehicle ownership costs are a further factor with cost per kg of hydrogen in the US at about $14. This equates to approximately $5.60 per gallon on a price per energy basis compared to $2.50 for gasoline. Parity in terms of mileage per gallon is reached at an example case of $3.50 per gallon of gasoline and $8 per kg of hydrogen, a price considered reachable by approximately 2025.

To overcome FCEV cost barriers and to close the cash gaps on investment returns, cost reductions along the whole value chain and efficiency improvements are necessary. Among the seven value-chain categories, HRS sits at the top of the list of issues hampering H2 mobility expansion.

In the last article of this series, Part 3: “From best practice to the global stage.”, we take a closer look at HRS requirements and present Californias approach on the infrastructural hurdle – an example with the potential to be introduced as blue print for the global stage.

Go to article Part 1: The window of opportunity for hydrogen mobility

Go to article Part 3: From best practice to the global stage (with white paper for download)

Published by Johannes Scherrer, accilium